Conducting an Annual General Meeting (AGM) serves as a crucial platform for your company to unveil its financial statements (accounts) to shareholders, providing them with valuable insights into the business’s financial health. This occasion offers shareholders the opportunity to pose inquiries and express any concerns they may have.

As part of the ongoing compliance regulatory obligations, all private limited and public listed companies incorporated in Singapore are required to hold their AGMs in accordance with Section 175, Section 197 and Section 201 of the Companies’ Act.

Understanding the statutory requirements that your company has to meet will be important in helping you prepare, anticipate and ensure that your company is able to meet the statutory deadlines in time. With the Accounting and Corporate Regulatory Authority (“ACRA”) ramping up its scrutiny and enforcement of errant companies and their directors, it would be prudent for companies to ensure that they do not default on these requirements.

The Companies’ Act governs all companies incorporated in Singapore and the holding of AGMs is one of the statutory requirements that all companies incorporated in Singapore need to comply with. The table below provides a summarised snapshot of the relevant sections and the different requirements:

Do note that publicly listed companies have to oblige by the statutes set out in the Companies Act and the relevant Mainboard listing manual or Catalist listing manual, depending on which one they are listed on the Singapore Stock Exchange Securities Limited (“SGX-ST”). Therefore, their requirements may differ.

Hence, when your company should hold its AGM is dependent on the following factors:-

Depending on these factors, your company and employees can pre-empt when they should start preparing documents and ensuring the company’s accounts are finalised. For example, knowing that the company’s AGM should not be held more than 6 months from the financial year end means that auditors should be triggered to start their audit within 2 to 3 months from the company’s financial year end.

The Registrar of Companies in Singapore requires companies to file annual returns, which must be submitted within a month following the company’s Annual General Meeting (AGM). Additionally, Singapore law mandates that annual tax returns must be filed by the 30th of November in the upcoming tax year.

For Exempt Private Companies (EPCs), the necessity for accounts submission and annual audits hinges on their annual turnover. EPCs with a turnover below S$10 million are exempt from mandatory accounts submission and annual audits as per Singapore law. Conversely, if an EPC’s annual turnover exceeds S$10 million, it is obligated to conduct annual audits. While filing returns, there is no requirement to attach the accounts, but a declaration of solvency must be completed.

With effect from 1 July 2015, there will be more companies that can qualify for audit exemptions, as follows:

| Current criteria for companies to benefit from audit exemptions | New criteria for companies to benefit from audit exemptions |

|---|---|

| Revenue not more than S$5 million | Meets any two of the following criteria*: |

*For companies that are part of a group, the entire group must qualify as a small group, i.e. it needs to meet at least two of these criteria on a consolidated basis for the immediate past two consecutive financial years.

Notably, even companies that are wholly owned and choose to dispense with the requirement to hold their AGM by way of passing resolutions will have to comply with the statutory requirements and address specific issues that are part and parcel of an AGM. These include:

In addition, there may be specific requirements set out in your company’s Memorandum & Articles of Association (“M&AA”), which will dictate how your company’s AGM should be held. Examples of such requirements include the minimum notice period for shareholders (typically this is either 14 or 21 days).

Ideally, do read your company’s M&AA in full, together with the Companies Act. Alternatively, you may wish to seek the advice of a professional corporate services provider, who would be able to advise you accordingly and assist in sending reminders to the relevant parties involved.

Post-incorporation, a company may decide for business or administrative reasons, to change its financial year end. For newly incorporated companies that have yet to hit the 18 month deadline from the date of its incorporation, any change in the financial year end will have no effect on when their AGM is due.

For companies that have already held their first AGM, however, the financial year end of the company may impact when its AGM should be held, in accordance with Section 201 in the table earlier. However, companies should ensure that it complies with both Section 175 and Section 201 of the Companies Act when deciding the date of their AGM, whichever deadline falls earlier.

For the change in financial year to take effect, the company would need to notify ACRA via the electronic portal known as Bizfile. To access Bizfile, one would need to have a SingPass and be appointed as an officer of the company (i.e. director or company secretary) or recognised as a filing agent before making the relevant notification with ACRA.

In addition, the company or its professional corporate services provider will prepare resolutions in writing for the directors of the company to note and approve the change in the company’s financial year end.

In situations where the company is unable to meet the deadline to hold its AGM under either Section 175 or Section 201, it may apply for an extension of time with ACRA, up to a maximum of two months. Do note that the application for each extension is done separately. If a company fails to meet the deadline and does not apply for an extension, ACRA will impose a composition fine.

If a company fails to meet the deadline and does not apply for an extension, ACRA will impose a composition fine. Based on information provided in the AR, several fees and penalties may be incurred:

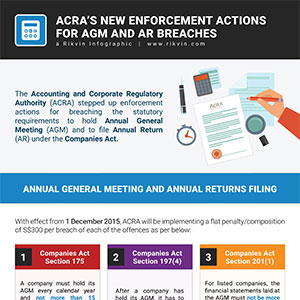

To know more, read our infographic on the new enforcement actions by the Accounting and Corporate Regulatory Authority (ACRA) for breaching the statutory requirements to hold Annual General Meeting (AGM) and to file Annual Returns (AR) under the Companies Act.

Depending on the circumstances, your company may only need to make an application under one Section. A professional corporate services provider would typically be able to advise the company on how it should proceed to do so.

Where a company is found to be persistently in default, Section 175(4) of the Companies’ Act provides that the company and every officer of the company (including its directors and company secretary) shall be liable on conviction to a fine not exceeding S$5,000.00 and also to a default penalty.

In addition, ACRA may take action against its directors and company secretary, such as the issuance of a court summons. In fact, it was reported that ACRA has in recent years, issued approximately 10,000 summonses annually to errant directors for failing to ensure that their companies meet the relevant statutory deadlines for the holding of their AGMs and filing of Annual Returns

In short, holding a company’s AGM is a process that not only includes multiple parties, i.e. the company’s auditors and / or finance team, directors and shareholders, but also requires sufficient knowledge of the Companies’ Act and the company’s M&AA.

Given the seriousness of defaulting on the requirement to hold their AGMs, most companies do prefer to engage a professional corporate service provider, which will ensure that the company is regularly updated and reminded of its statutory requirements. By doing so, the directors, employees and shareholders can rest assured and focus on driving the company’s business and running its operations.

We are experts when it comes to Singapore's company laws and regulations. Thousands of companies rely on us to fulfil their annual statutory requirements.